Future-proof your finances with tailored offshore trusts asset protection plans.

Exploring the Conveniences of Offshore Trust Fund Possession Protection for Your Wealth

When it comes to safeguarding your riches, overseas counts on can supply significant benefits that you might not have considered. Let's explore what offshore counts on can do for you.

Understanding Offshore Trusts: A Guide

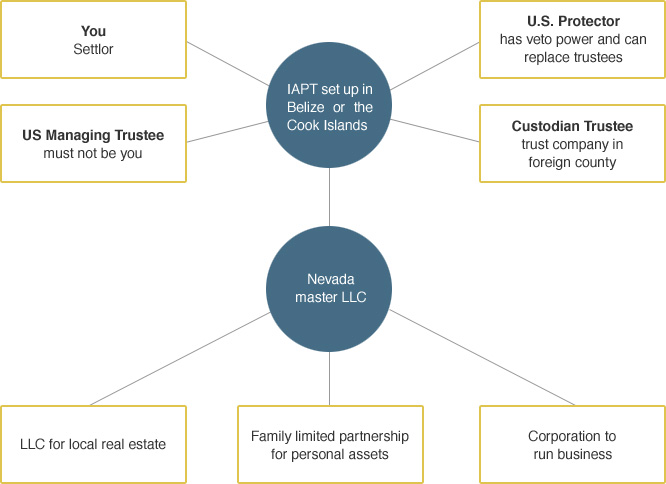

Offshore trust funds offer an one-of-a-kind method to handle and protect your properties, and understanding their basics is essential. These trusts enable you to position your wealth outside your home country, usually in jurisdictions with positive tax obligation regulations and privacy protections. When you established an overseas trust, you're essentially moving your assets to a trustee, who handles them according to your defined terms. This framework can aid you maintain control over your riches while minimizing direct exposure to local liabilities and taxes.

Additionally, offshore trust funds usually provide confidentiality, protecting your monetary affairs from public analysis. By comprehending these fundamentals, you can make enlightened decisions regarding whether an overseas trust fund straightens with your asset defense method and long-term economic goals.

Lawful Defenses Provided by Offshore Trust Funds

When you establish an offshore trust, you're touching into a durable framework of lawful protections that can protect your assets from numerous risks. These counts on are often controlled by beneficial regulations in offshore jurisdictions, which can give stronger defenses versus creditors and lawful cases. Several offshore counts on profit from legal protections that make it challenging for financial institutions to access your assets, even in personal bankruptcy scenarios.

Furthermore, the splitting up of lawful and beneficial possession suggests that, as a beneficiary, you don't have straight control over the assets, complicating any type of efforts by creditors to seize them. Lots of overseas territories additionally restrict the time framework in which asserts can be made against depends on, including one more layer of security. By leveraging these legal defenses, you can significantly improve your economic security and protect your wealth from unanticipated hazards.

Personal Privacy and Confidentiality Advantages

Establishing an offshore count on not only provides robust legal protections but also guarantees a high level of privacy and confidentiality for your assets. When you established an offshore depend on, your economic affairs are protected from public scrutiny, assisting you keep discernment regarding your wealth. This privacy is necessary, particularly if you're worried concerning potential lawsuits or undesirable interest.

In several offshore territories, laws secure your personal details, meaning that your assets and financial ventures continue to be personal. You will not have to fret about your name showing up in public records or economic disclosures. Furthermore, working with a trustworthy trustee makes certain that your info is dealt with securely, more improving your privacy.

This degree of confidentiality permits you to handle your riches without anxiety of direct exposure, providing satisfaction as you protect your financial future. Eventually, the personal privacy benefits of an overseas count on can be a substantial advantage in today's significantly transparent world.

Tax Benefits of Offshore Trust Funds

One of the most engaging reasons to ponder an overseas count on is the capacity for substantial tax obligation advantages. Establishing an overseas trust fund can help you decrease your tax responsibilities legitimately, depending on the jurisdiction you select. Several offshore jurisdictions provide desirable tax rates, and in many cases, you could also take advantage of tax exceptions on revenue created within the trust.

By moving possessions to an overseas trust fund, you can divide your individual wide range from your gross income, which might decrease your general tax obligation burden. In addition, some territories have no resources gains tax obligation, permitting your financial investments to expand without the prompt tax effects you find more 'd face domestically.

Possession Diversification and Financial Investment Opportunities

By producing an overseas depend on, you unlock to property diversity and one-of-a-kind investment opportunities that may not be available in your house nation. With an overseas depend on, you can access numerous international markets, allowing you to buy property, stocks, or products that might be limited or much less favorable domestically. This international reach aids you spread out threat throughout various economies and sectors, securing your riches from neighborhood economic declines.

Additionally, offshore counts on typically offer access to specialized investment funds and alternate possessions, such as private equity or bush funds, which may not be offered in your house market. These options can boost your profile's growth possibility. By expanding your financial investments worldwide, you not only strengthen your economic setting however also acquire the flexibility to adjust to altering market problems. This calculated method can be vital in maintaining and growing your wide range gradually.

Succession Preparation and Wealth Transfer

When taking into consideration how to hand down your wealth, an overseas trust can play an essential function in effective sequence preparation. By establishing one, you can assure that your possessions are structured to offer your enjoyed ones while lessening potential tax implications. An overseas trust enables you to dictate how and when your beneficiaries obtain their inheritance, supplying you with peace of mind.

You can select a trustee to take care of the trust, ensuring your desires are performed even after you're gone (offshore trusts asset protection). This arrangement can likewise protect your properties from lenders and legal difficulties, securing your household's future. In addition, offshore trust funds can offer privacy, keeping your monetary matters out of the general public eye

Inevitably, with mindful preparation, an overseas trust can act as a powerful tool to help with wealth transfer, ensuring that your tradition is maintained and your liked ones are looked after according to your desires.

Picking the Right Territory for Your Offshore Depend On

Picking the right jurisdiction for your offshore count on is an essential consider optimizing its advantages. You'll intend to ponder aspects like lawful structure, tax obligation effects, and asset protection legislations. Different jurisdictions offer differing levels of privacy and stability, so it is critical to study each choice completely.

Search for locations recognized for their favorable trust fund regulations, such as the Cayman Islands, Bermuda, or Singapore. These jurisdictions often provide durable legal protections and an online reputation for financial safety.

Likewise, think concerning availability and the simplicity of handling your count on from your home country. Consulting with a lawful expert specialized in offshore trust funds can assist you in steering via these complexities.

Ultimately, picking the excellent territory can enhance your property security approach and ensure your wealth is secured for future generations. Make informed choices to secure your economic legacy.

Regularly Asked Questions

Can I Establish up an Offshore Count On Without a Lawyer?

You can practically set up an overseas count on without a legal representative, however it's high-risk. You may miss vital legal subtleties, and problems can emerge. Employing her response a professional warranties your trust adheres to laws and protects your rate of interests.

What Occurs if I Transfer To An Additional Nation?

Are Offshore Trusts Legal in My Nation?

You'll require to check your regional regulations to determine if overseas counts on are legal in your nation. Regulations differ extensively, so seeking advice from a lawful expert can help ensure you make notified choices concerning your assets.

How Are Offshore Counts On Controlled Worldwide?

Offshore trusts are regulated by worldwide regulations and standards, varying by jurisdiction. You'll find that each country has its own policies pertaining to taxes, reporting, and compliance, so it's vital to comprehend the specifics for your scenario.

Can I Accessibility My Properties in an Offshore Trust?

Yes, you can access your properties in an overseas trust fund, but it depends upon the depend on's framework and terms. You must consult your trustee to comprehend the specific processes and any type of restrictions involved.

Conclusion

To sum up, overseas depends on can be a clever selection for shielding your wide range. By using legal safeguards, privacy, and prospective tax obligation advantages, they assist you secure your properties and plan for the future. Plus, the chance for diversification and international financial investments can enhance your monetary growth. When thinking about an offshore trust fund, put in the time to select the best jurisdiction that straightens with your goals. With the right approach, you can genuinely secure your monetary legacy - offshore trusts asset protection.